New Beginnings: Unveiling the Chapters of 2024 in Our First Newsletter of the Year!

Embark on 2024's journey with cutting-edge insights in fintech and the latest breakthroughs in science and technology. Greetings and welcome to the inaugural edition of 2024!

As we step into the promising horizon of 2024, our newsletter pioneers a journey through the dynamic landscapes of blockchain, digital economic policies, and incredible strides in science and technology. No more information overload – we're your compass in the digital age. In the spirit of the New Year, we extend our warmest wishes to our discerning readers. As we usher in this exciting era, our commitment to delivering meaningful content remains unwavering.

Anticipating growth on the horizon, we're gearing up to introduce content in the realm of quantitative finance, custom-tailored to your preferences. Until then, immerse yourself in our carefully curated newsletter, a beacon guiding you through the essential updates in the realms of blockchain, digital economics, and the forefront of science and technology.

Here's to a year of unparalleled discoveries, continuous evolution, and shared intellectual adventures. Welcome to a New Year filled with insights that matter.

TABLE OF CONTENTS:

Blockchain And digital currency 💻💰

Scientific advancements 🧪⚙️

1. BLOCKCHAIN AND DIGITAL CURRENCY

SEC approves Bitcoin ETFs, facilitating simplified access to the largest cryptocurrency.

U.S. regulators just gave the green light to Bitcoin ETFs, opening up a whole new world for crypto enthusiasts. The Securities and Exchange Commission (SEC) approved key filings from about a dozen companies, including heavyweights like BlackRock and Fidelity. These are spot ETFs, meaning they hold actual Bitcoin, not just derivatives contracts.

This decision comes after years of delays and rejections, with a recent court ruling prompting the SEC to reconsider. SEC Chair Gary Gensler mentioned that the court loss in 2023 played a role in their decision to approve the spot Bitcoin ETFs.

For those not knee-deep in crypto, this move is a game-changer. It allows both institutional and retail investors to jump into the Bitcoin game without dealing with digital wallets. ETF shares will be up for grabs to any U.S. investor with a brokerage account. The crypto market is buzzing, with Bitcoin's price soaring past $47,500 post-announcement. It's a win for Bitcoin enthusiasts and a milestone in the history of digital assets.

Turkey is progressing to the second phase of its CBDC trials, with a decision potentially on the horizon by the end of the year.

Turkey is making strides in the digital currency world! The Central Bank just wrapped up phase one of its CBDC pilot, teaming up with tech heavyweights like Aselsan and Havelsan. With almost half of its population under 35, Turkey aims to tackle financial inclusion, tapping into its 40% unbanked population. The plan involves a hybrid DLT system, testing the waters with banks and fintechs. Embracing self-sovereign identity, Turkey wants individuals to control their data but is wary of potential issues over time. The goal is a unified payment system across providers, ensuring transactions still flow even if a bank hits a temporary snag. The next phase will dive into interoperability, offline payments, and economic considerations. Turkey's not just looking local; it plans to team up internationally for cross-border CBDC exploration.

SIX, SBI's AsiaNext introduces cryptocurrency derivative trading

Singapore-based AsiaNext, a digital asset trading venue co-founded by SIX and SBI Digital Asset Holdings, has launched its cryptocurrency derivatives trading platform. Notable trading members include Wintermute and SBI-owned B2C2. AsiaNext aims to minimize counterparty and settlement risks, offering capital efficiencies through intraday margining and settlement. The platform supports high-frequency trading and operates 24/7 for crypto derivatives trading. The move comes as traditional financial institutions explore digital asset exposure. With a Monetary Authority of Singapore license as a Recognised Market Operator, AsiaNext prioritizes regulation and governance for institutional investors seeking a secure venue in the expanding digital asset ecosystem. The platform's launch aligns with potential increased demand for hedging with the anticipated approval of the first U.S. spot bitcoin ETFs.

2. SCIENCE AND TECHNOLOGY

Walmart unveils generative AI search and AI replenishment functionalities at CES

Walmart's CEO Doug McMillon spilled the beans at CES in Vegas about their tech makeover for a better shopping experience. They're diving into augmented reality, drones, and AI. Newbies include AI tools for easy product hunting and a cool AR social shopping thing called "Shop with Friends." Big news: Walmart's iOS app now flaunts a smart search feature using generative AI. Say goodbye to typing brand names – just tell Walmart what you're up to, like a "football watch party," and boom, suggestions galore. Also, they're testing AI for auto-reordering your usual stuff. Think of it as a genius shopping buddy. Right now, it's part of Walmart InHome, delivering straight to your fridge.

The Custom GPT Store by OpenAI is officially open for business

OpenAI's GPT Store has finally launched, allowing users to share their customized chatbots. After a slight delay, the platform is now live for ChatGPT Plus and Enterprise users, as well as a new tier called Team. The store comes after the GPT Builder program's success, with over 3 million user-created bots. The platform enables sharing of personalized versions of ChatGPT, but currently, only subscribers to OpenAI's paid tiers can create and use custom GPTs. OpenAI plans to introduce a revenue sharing program in Q1, compensating GPT creators based on user engagement. The company has implemented a review system to ensure compliance with brand guidelines and usage policies, emphasizing user safety. The ChatGPT Team, priced at $25/month/user annually, caters to smaller teams, offering access to GPT-4 and other features, with a commitment to data privacy.

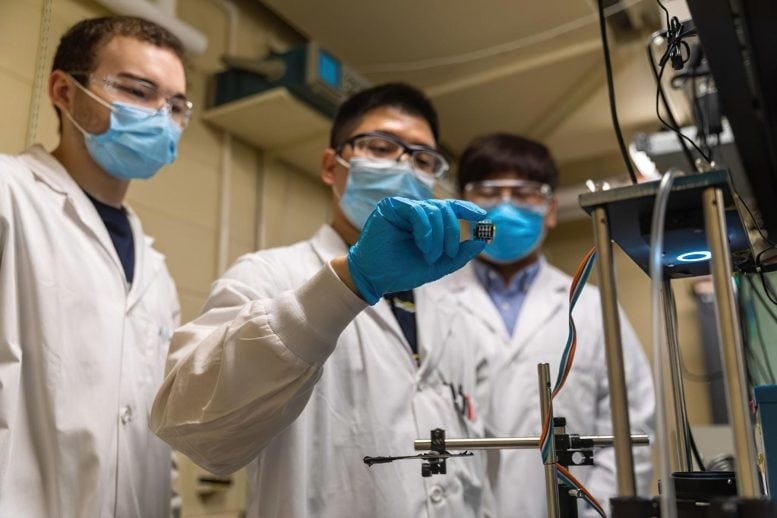

Revolutionizing Solar Energy: Record-Breaking 25.1% Efficiency Achieved in Perovskite Cells

Northwestern University researchers have made strides in enhancing perovskite solar cell efficiency by introducing a dual-molecule solution, addressing challenges in electron loss during energy conversion. Published in Science, the study achieved a 25.1% efficiency, surpassing previous 24.09% benchmarks. The approach focused on combating surface recombination and interfacial recombination issues. Northwestern professor Ted Sargent emphasized the pivotal role of interface research for perovskite solar technology advancement. Perovskite cells, with tunable light absorption, offer a promising, cost-effective alternative to conventional silicon cells. The team's innovative dual-molecule strategy involved using PDAI2 to address interface recombination and sulfur to repair surface defects. The researchers aim to encourage further exploration within the scientific community and plan to adopt a flexible strategy involving multiple molecules to comprehensively tackle interface challenges.